Things To Consider If Your House Didn’t Sell

If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to think about as you figure out what to do next.

Did You Limit Access to Your House?

One of the biggest mistakes you can make when selling your house is restricting the days and times when potential buyers can tour it. Being flexible with your schedule is important, even though it might feel a bit stressful to drop everything and leave when buyers want to see it. After all, minimal access means minimal exposure to buyers. ShowingTime advises:

“. . . do your best to be as flexible as possible when granting access to your house for showings.”

Sometimes, the most determined buyers might come from far away. Since they’re traveling to see your house, they may not be able to change their plans easily if you only offer limited times for showings. So, try to make your house available as much as you can to accommodate them. It's simple – if no one’s able to look at it, how will it sell?

Did You Make Your House Stand Out?

When you're selling your house, the old saying matters: you never get a second chance to make a first impression. Putting in the work to make the exterior of your home look nice is just as important as how you stage it inside. Freshen up your landscaping to boost your home’s curb appeal so you can make an impact upfront. As an article from U.S. News says:

“After all, if people drive by, but aren’t interested enough to walk through the front door, you’ll never sell your house.”

But don’t let that impact stop at the front door. By removing personal items and reducing clutter inside, you give buyers more freedom to picture themselves in the home. Plus, a fresh coat of paint or thorough floor cleaning can work wonders in sprucing up the house for potential buyers.

Did You Price Your House at Market Value?

Setting the right price is key. While it might be tempting to push the price higher to maximize your profit,

If buying or selling a home is your goal for 2024, it’s important to understand today’s housing market, know your why, and work with industry experts to bring your homeownership vision for the new year into focus. Over the last year, the economy had a big impact on the housing market, and likely on your wallet too. That’s why it’s critical to have a clear picture of not just the market today, but also on what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at Realtor.com, explains: Here are a few things to think through as you define your goals for 2024. You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are still many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time. Use your why and your motivation as a guidepost in partnership with an expert advisor to make sure your move gives you a lasting sense of accomplishment. You know you want to move, but how would you describe your dream home? The number of homes for sale has grown recently, and that could mean more options to choose from when you buy. But overall housing supply is still lower than more normal years in the market, so you’ll have to work closely with a pro to find what you’re looking for. Just be sure to keep your budget in mind as you balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it will be to find a home that’s right for you. Getting clear on your budget and available

If you're thinking about selling your house on your own, called “For Sale by Owner” or FSBO, there are some important things to consider. Going this route means taking on a lot of responsibilities by yourself – and that can be a bit of a headache. A recent report from the National Association of Realtors (NAR) found two of the most difficult tasks for people who sell their house on their own are getting the price right and understanding and performing paperwork. Here are just a few of the ways an agent helps with those difficult tasks. Setting the right price for your house is important when you're trying to

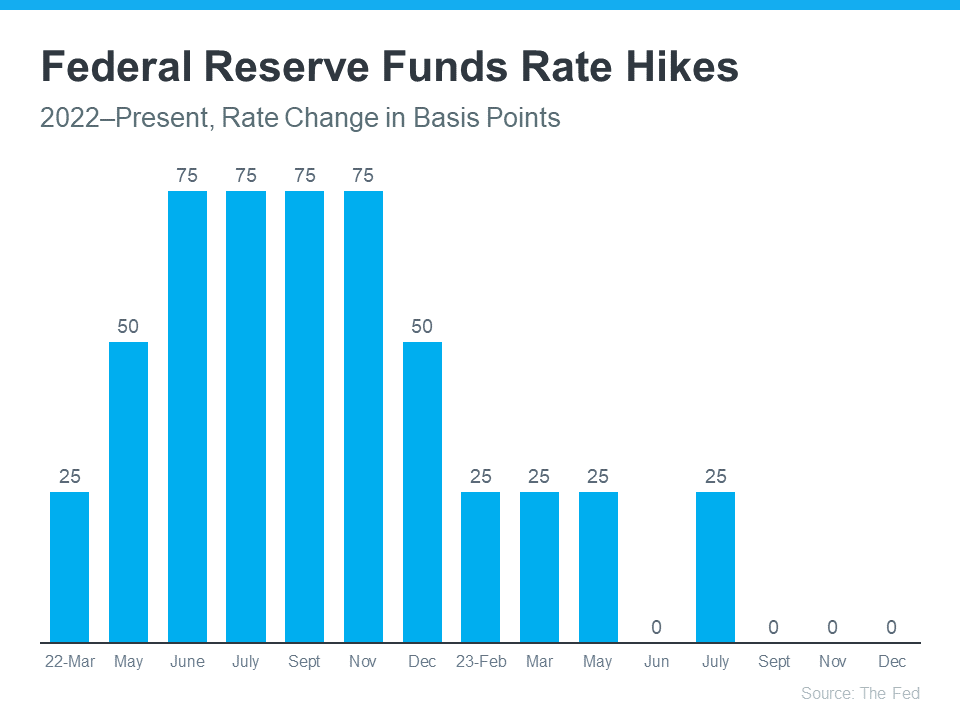

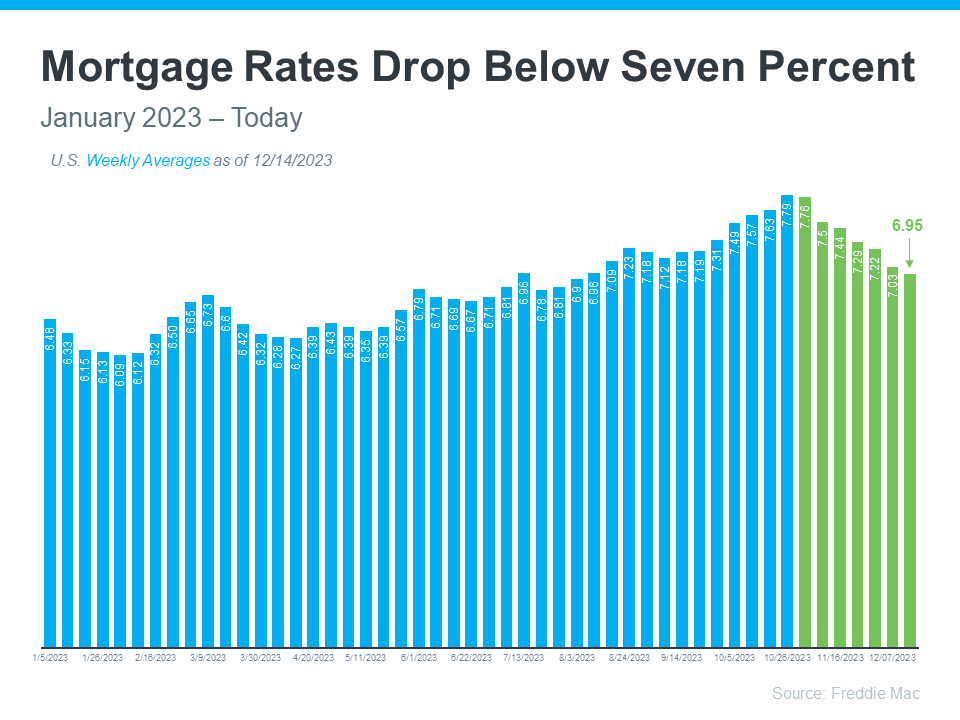

When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here's what you need to know. One of the Fed’s primary goals is to lower inflation. In order to do that, they started raising the Federal Funds Rate to slow down the economy. Even though this doesn’t directly dictate what happens with mortgage rates, it does have an impact. Recently inflation has started to cool, a signal those increases worked and are bringing inflation back down. As a result, the Fed’s hikes have gotten smaller and less frequent. In fact, there haven’t been any increases since July (see graph below): And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met, they’ve signaled there may actually be rate cuts coming in 2024. According to the New York Times (NYT): This indicates the Fed thinks the economy and inflation are improving. Why does that matter to you and your plans to buy a home? It could end up leading to lower mortgage rates and improved affordability. Mortgage rates are influenced by a wide variety of factors, and inflation and the Fed’s actions (or as has been the case recently, inaction) play a big role. Now that the Fed has paused the increases, it looks more likely mortgage rates will continue their downward trend (see graph below): Although mortgage rates may remain volatile, their recent trend combined with expert forecasts indicate they could continue to go down in 2024. That would improve affordability for buyers and make it easier for sellers to move since they won’t feel as locked-in to their current, low mortgage rate. The Fed’s decisions have an indirect impact on mortgage rates. By not raising the Federal Funds Rate, mortgage rates are likely to continue declining. Let’s connect so you have expert advice about changes in the housing market and how they affect you.

3 Keys To Hitting Your Homeownership Goals in 2024

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.”

1. Know Your Why

2. Figure Out What Your Next Home Needs To Look Like

3. Determine if You’re Ready To Buy

Sell Smarter: Why Working with a Real Estate Agent May Beat Going Solo

Getting the Price Right

Why Mortgage Rates Could Continue To Decline

The Federal Funds Rate Hikes Have Stalled

“Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation.”

Mortgage Rates Are Coming Down

Bottom Line