A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However, this market is very different than it was during the housing crash 15 years ago. Here are four key reasons why today is nothing like the last time.

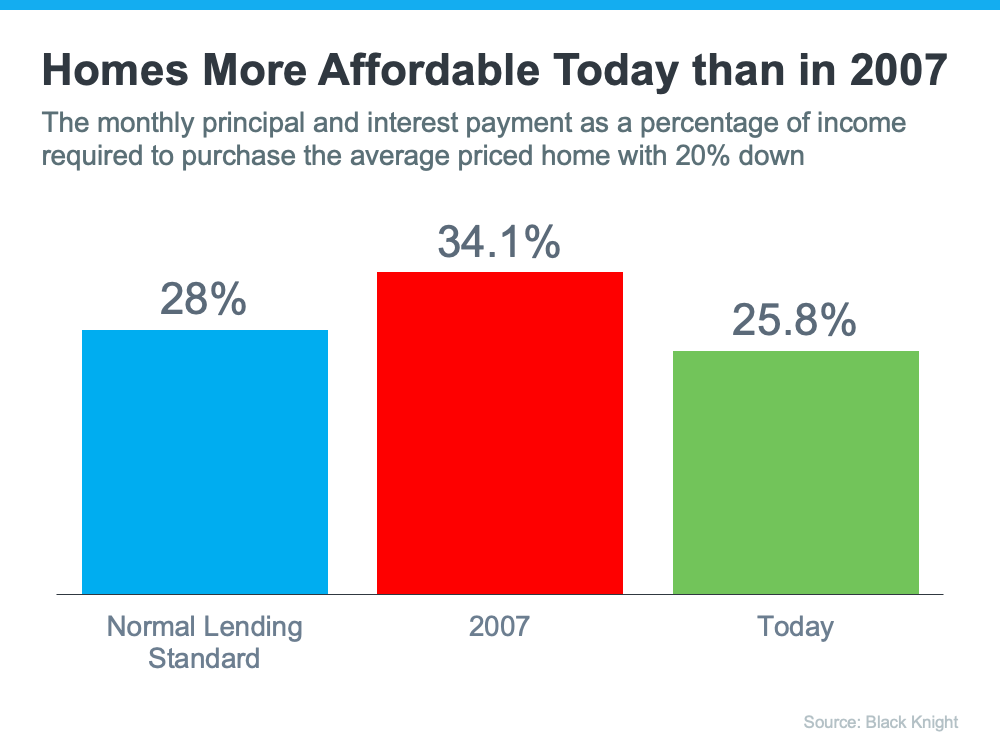

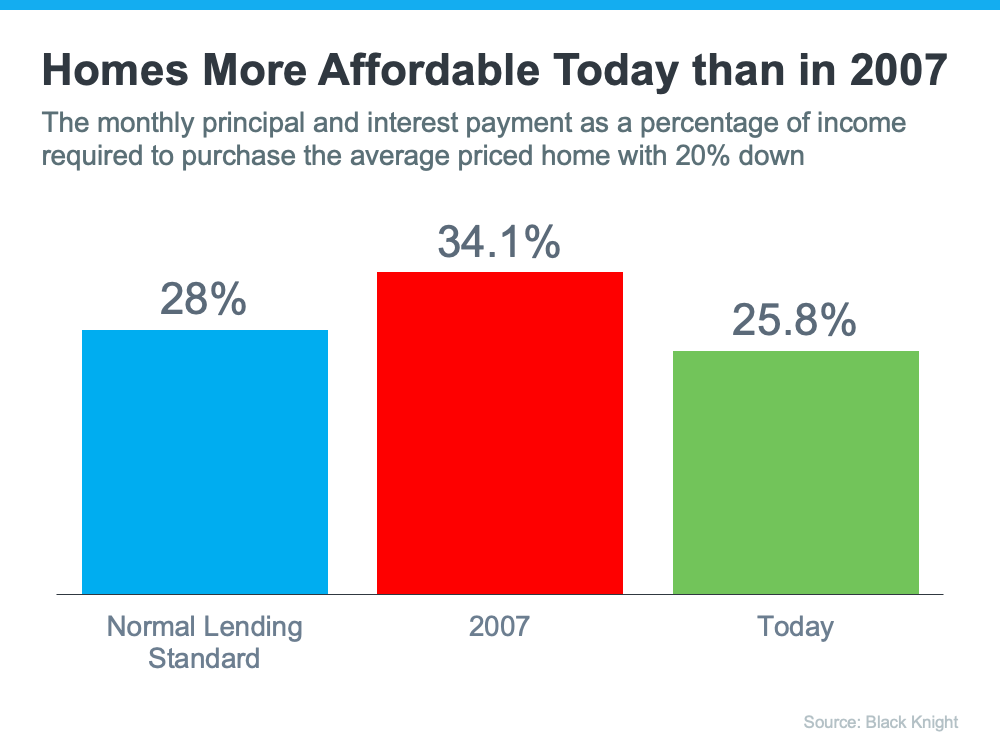

1. Houses Are Not Unaffordable Like They Were During the Housing Boom

The affordability formula has three components: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time. Conventional lending standards say a purchaser should not spend more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate, even after the recent spike, is still well below 6%. That means the average purchaser today pays less of their monthly income toward their mortgage payment than they did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta addresses that exact point:

“The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward.”

Affordability isn’t as strong as it was last year, but it’s much better than it was during the boom. Here’s a chart showing that difference:

If costs were so prohibitive, how did so many homes sell during the housing boom?

2. Mortgage Standards Were Much More Relaxed During the Boom

During the housing bubble, it was much easier to get a mortgage than it is today. As an example, let’s review the number of mortgages granted to purchasers with credit scores under 620. According to credit.org, a credit score between 550-619 is considered poor. In defining those with a score below 620, they explain:

“Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk.”

Buyers can still qualify for a mortgage with a credit score that low, but they’re considered riskier borrowers. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the 14 years since.

Mortgage standards are nothing like they were the last time. Purchasers that acquired a mortgage over the last decade are much more qualified. Let’s take a look at what that means going forward.

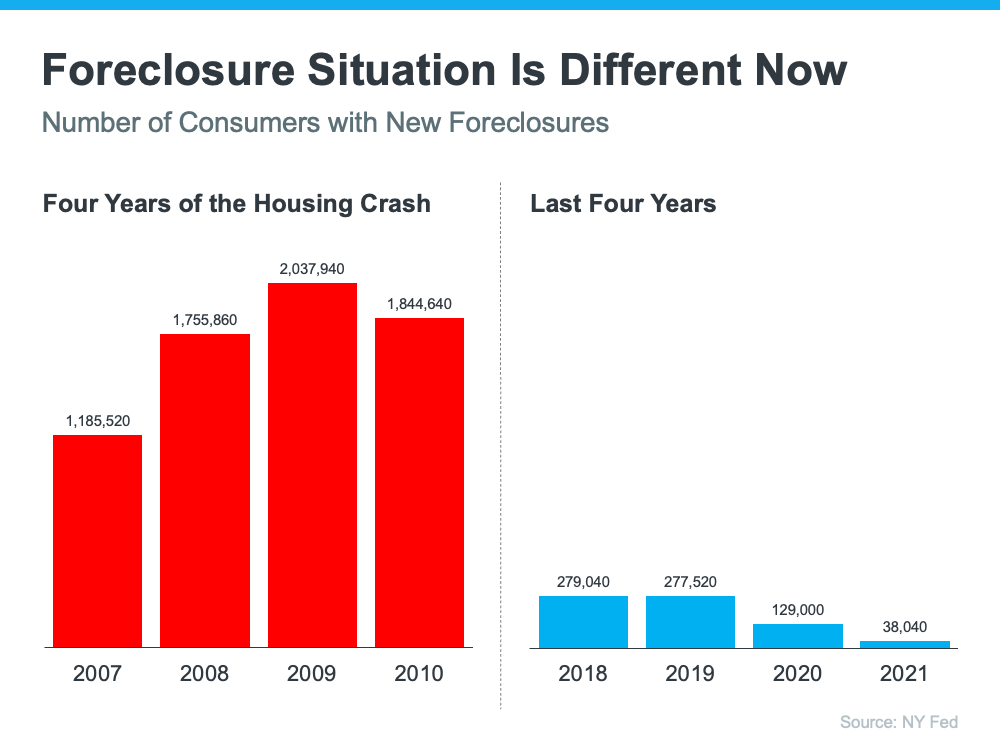

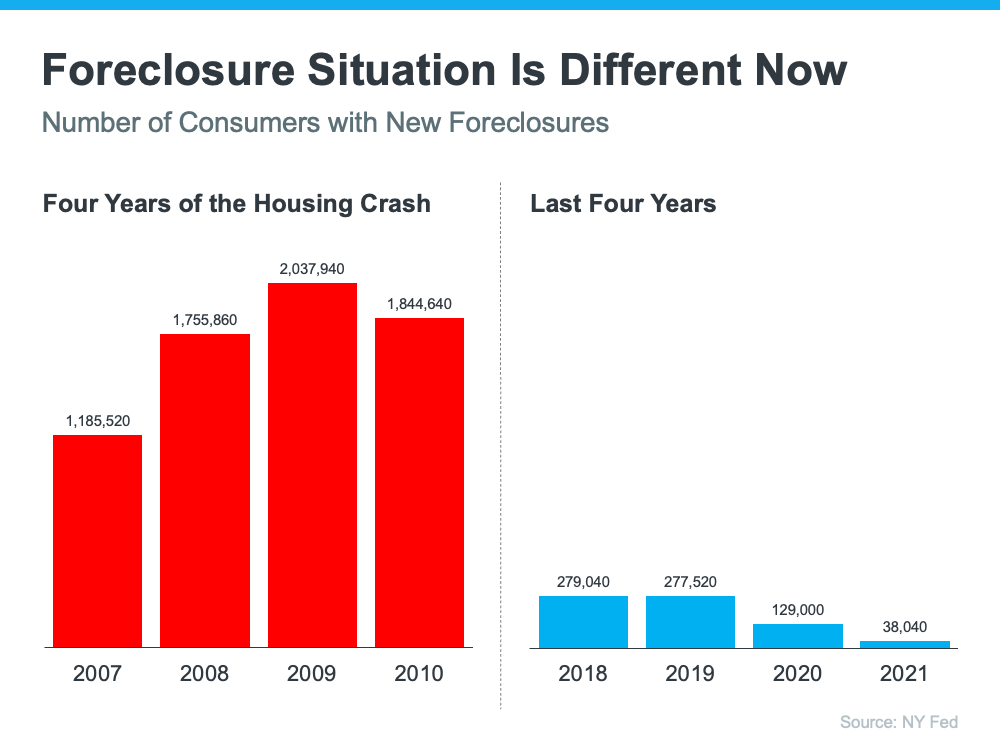

3. The Foreclosure Situation Is Nothing Like It Was During the Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

There’s no doubt the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. However, there are fewer than 800,000 homeowners left in the program today, and most of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains:

“The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure’ narrative was incorrect.”

Why are there so few foreclosures now? Today, homeowners are equity rich, not tapped out.

In the run-up to the housing bubble, some homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area.

Homeowners, however, have learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like the last time, as evidenced by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000, what happened last time won’t happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains:

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth.”

There will be nowhere near the same number of foreclosures as we saw during the crash. So, what does that mean for the housing market?

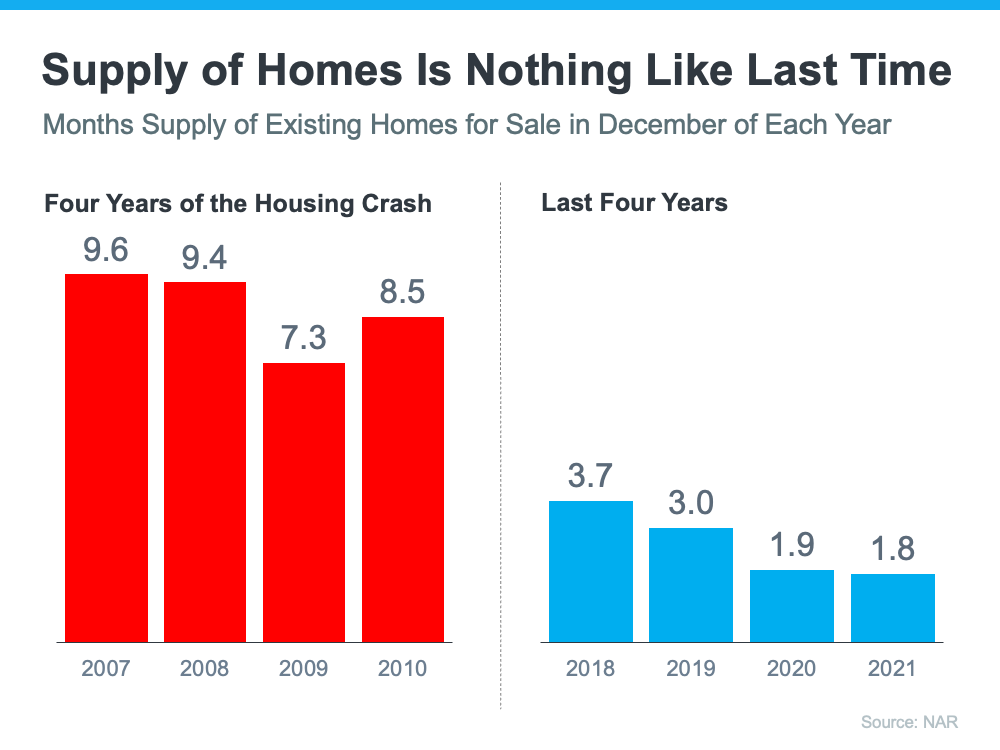

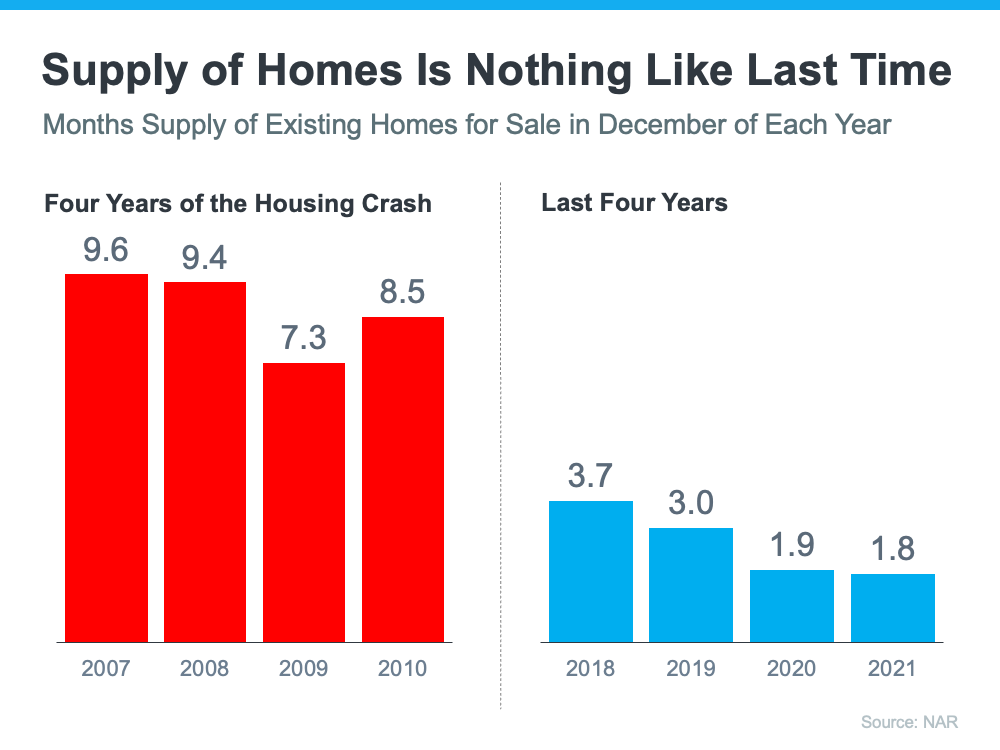

4. We Don’t Have a Surplus of Homes on the Market – We Have a Shortage

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. As the next graph shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing the acceleration in home values to continue.

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a shortage of homes for sale.

Bottom Line

If you’re worried that we’re making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns.

You might also enjoy reading...

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

![What’s Driving Today’s High Buyer Demand? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/16141829/20220218-MEM.png)

![How To Win as a Buyer in a Sellers’ Market [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/10091313/20220211-KCM-Share-150x150.png)

![How Remote Work Impacts Your Home Search [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/03134354/20220204-KCM-Share-150x150.png)

![Why Your Home Inspection Matters [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/01/27130250/20220128_KCM-Share-150x150.png)

![Americans Choose Real Estate as the Best Investment [INFOGRAPHIC]](https://files.simplifyingthemarket.com/wp-content/uploads/2022/01/20142536/20220121-KCM-Share-150x150.png)